Climate Risks Travel Across Geographic Boundaries and Across Sectors – Can Europe’s Economy Be Shook Up By Climate Impacts, Both Within Europe and Outside?

Given the reality of globalisation, climate risk is in many cases “borderless” in nature. Climate impacts in one country will create risks and opportunities in other countries, due to cross-border connectivity within regions and globally.

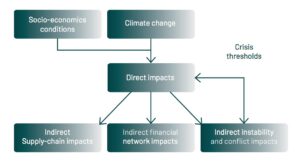

PlanAdapt, in collaboration with Global Climate Forum, conducted a study on near term climate impacts with significant economic risks for the EU economy. The relevance of climate impacts for the EU economy was explored through the development of qualitative future scenarios. Direct physical climate impacts in the EU, as well as indirect transboundary climate impacts, were identified as well as their anticipated effect on the economic and financial system in Europe. The study was embedded in the “Transformative responses to the crisis” project by Finance Watch Deutschland and Heinrich-Böll-Foundation that aims at developing scenarios for future economic and financial crisis and creating policy proposals that transform our economic system towards sustainable economies.

The recently published study report provides orientation regarding potential future developments by examining six scenarios of climate impacts that can trigger social, political, economic or financial crises in Europe in the next decade. These scenarios are not predictions about what is likely going to happen. Each scenario is initially rather unlikely but becomes more probable each year. Therefore, low probability high impact scenarios should not be dismissed. Imagine what great length’s we go through as a society to prevent airplanes from crashing, even if the actual probability of a plane crash is minuscule. Nobody would consider boarding a plane if he had a 1% probability of a fatal crash.

Little Attention to Climate Impacts that Could Lead to a Substantial Near-Term Economic Crisis

While climate change and responses are being widely discussed by European decision-makers, there seems to be little attention to climate impacts that could lead to a substantial near-term economic crisis. This is particularly important for governments and societies in Europe, which generally have the capacity to adapt to incremental increases in risks and associated costs brought on by climate change, but may be less aware of, and well-prepared for, residual risks of high-impact, low-likelihood climate impacts that can lead to crisis.

The authors, hence, looked at scenarios of low probability, but high impact of a scale that could trigger a political, economic or financial crisis within Europe. Six scenarios were identified:

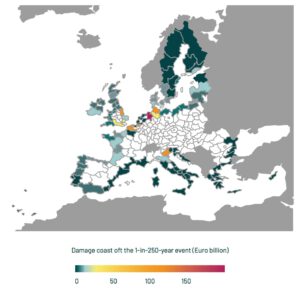

including coastal protection (source: Lincke et al. 2018)

- Major river flooding in central Europe or coastal defence failure during a major storm surge in western Europe, causing hundreds of billions in damages.

- Prolonged drought in southern Europe leads to crop loss, decreased tourist arrivals, and conflict between water users. Social unrest exacerbates the economic impacts leading to economic crisis.

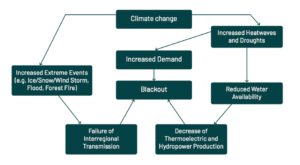

- Power supply failure due to an extreme weather event (e.g. storm, flooding) or a demand peak, during cooling water shortages due to drought and high temperatures.

- Flooding induces a rapid drop in US coastal real estate prices inducing a global financial crisis.

- Extreme weather events in key producing regions and transportation hubs disrupting agricultural trade flows.

- Armed conflict in Sahel leading to large-scale migration to Europe

‘Tail Risks’ Are the Potential Triggers of Crisis in the Near-Term

The study found that climate-induced crisis triggers remain so-called ‚tail risk‘ events for Europe at least in the relatively near-term. Tail risks are risks of rare events with catastrophic effects. These tail risks are of two different types. The first type is the ‚tail risk‘ of an event or conjunction of events that can be quantified with some (low) probability. For example, in the case of both coastal and river flooding, probability distributions of extreme events are available and can be applied to assess current risks and project risks into the future. However, it should be noted that this assignment of probability should be treated with a great deal of caution due to short observational record.

This type of tail risk includes: very low probability coastal or river flood events, i.e. high return period or dike failure, because of high protection measures (Chapter 2); it also includes low probability drought events leading to both crop losses, and more significantly for crisis risk, severe reductions in tourist arrivals and thus tourism revenues (Chapter 3). For such events, adaptation measures, or preparation measures, such as, disaster risk financing pools for flooding might be calculated quantitatively up to a level that would ensure that such “tail events” do not reach the scale of a larger crisis by having enough capital available to ensure a rapid recovery. Such measures are not currently in place, as current disaster risk financing arrangements in Europe, e.g. the Europe Solidarity Fund, would be overwhelmed by a 1-in-250 flood event spanning several central European countries. Given the present risks of crises resulting from such flooding or drought events, it appears worthwhile to consider what level and sources of disaster risk finance could be put in place to reduce these risks.

A second type of ‚tail risk‘ events are those for which it is not possible to assign probabilities. These include: Blackouts in Europe due to failure of electricity grid during periods of low cooling water availability (Chapter 4); US coastal real estate correction leading to a global financial crisis (Chapter 5); outbreak of a large-scale armed conflict in the Sahel and subsequent migration (Chapter 7). Here, it is difficult to quantify the degree of risk involved, and consideration of measures to reduce these risks can be taken on a more ‚precautionary principle‘ or ‚no regrets‘ basis, aiming to adjust systems in such a way as to avoid that these risks materialise at all. For instance, in the case of coastal real estate, collective flood protection measures, such as, coastal protection or managed retreat, could avoid crises from real estate corrections, and ensure a ‘smooth transition’ to more sustainable, resilient and equitable coastal cities. Such measures require early and sustained stakeholder engagement across multiple levels, and from multiple sectors, including government, scientists, business and civil society. In the case of a migration crisis, avoiding future crises points to the need for Europe to support climate-resilient development international, as well as, also to the need to develop a sustainable and resilient domestic economy that can manage sustainable refugee integration to avoid such socio-political repercussions and reap the society and economy-wide benefits of successfully integrated new arrivals.

Climate Impacts Alone Are Unlikely to Cause Catastrophic Failure – The Socio-Economic Settings and Frameworks Matter and Need to Be Adapted

It is emphasised that a lack of considering long-term resilience in economic recoveries, would leave such recoveries prone to failure, laying the seeds for the next, even more catastrophic collapse. For flooding, either within Europe or beyond, such crisis risks are evident as the dynamics of decisions around flood plain and coastal real estate development tend to reinforce short-term decision-making, and asset development in the floodplain. But these concerns are applicable to all of the crisis reviewed here, as food security, large-scale migration, and energy security will be put under increasing pressure by unabated climate change.

Find the full report here.

Further recommended readings:

Cascading Climate Impacts: a new factor in European policy-making. This policy brief sets out the main area of interest of the new CASCADES project (Cascading climate risks: Towards adaptive and resilient European societies).

One thought on “Climate Impact Induced Crisis in Europe – PlanAdapt and Global Climate Forum Developed Qualitative Risk Scenarios”